Appraisals

Valuations That Withstand Challenge

A properly prepared appraisal report is a sound legal document, a document you can stand behind when defending the valuation of your decorative and fine arts. Not all attempts at valuation are equal. Sales receipts or a one-page letter with an opinion of value will break down when challenged.

Our meticulous research and thorough analysis of comparable sales and current market conditions gives clients confidence and security in our appraisals. That's how Roth Art Group establishes a justifiable value — one that meets the strict requirements of insurance, legal, financial and governmental institutions — one that clients trust and can count on.

Insurance Coverage & Damage/Loss Claims

"An ounce of prevention is worth a pound of cure" - Benjamin Franklin

Our clients know that having complete coverage up front is far better than relying on blanket policy coverage when guarding against the risk of damage or loss to their fine and decorative art collections. How do you ensure you have adequate coverage? An up-to-date appraisal, compliant with your insurance carrier's requirements, determines the accurate replacement value for coverage.

We provide our clients sound appraisals, based on up-to-date market conditions. Should part or all of your collection incur damage or loss, that up-to-date appraisal with our accurate value conclusions will eliminate the chances of disputes making the claims process easier and ensure complete compensation.

Probate/Estate & Gift Tax

The IRS and courts have strict rules for probate and estate tax reporting. Appraisals by an expert independent appraiser are usually required to establish the estate's value. At Roth Art Group, we are experts at appraising antiques, decorative arts and fine arts.

Our clients count on us and our experience to compile the fair market value appraisals they submit to the IRS. We keep up to date on all IRS reporting requirements, by regularly attending IRS seminars. When a question arises, we consult directly with the IRS Art Advisory Panel to ensure we comply with their reporting procedures. The diligence, meticulous research and thorough analysis we invest in putting together your fair market value appraisal ensures your value claims will be accepted by the IRS.

Estate Planning

Knowledgeable clients plan ahead for the distribution of assets in their estate. Good estate planning should reduce estate distribution related expenses, including taxes, and assure the desired transfer of assets to heirs. In order to develop the most effective estate plan possible, your advisors need a complete accounting of your net worth — one that encompasses all your valuable assets, including your fine and decorative arts.

Roth Art Group knows what's required to correctly value your works of art for effective estate planning. We frequently advise clients on valuation questions and provide them complete fair market value appraisal reports of their artistic assets — giving them confidence that their estate planning efforts will be thorough and accurate.

Charitable Donations

Donating all or part of your fine and decorative art collection to a public or charitable institution passes on a significant benefit to the community. That generosity is recognized by the IRS in the form a charitable donation deduction, but qualifying for the deduction is often not straight forward.

There are a number of factors, including usage, that dictate whether the donation qualifies as a deduction or not. Roth Art Group has prepared numerous appraisal reports that meet the strict requirements of the IRS for charitable donations. Clients count on our thorough appraisals to qualify for the deduction.

Divorce & Division of Property

The dissolution of property requires fair, objective and impartial valuations. We work with attorneys and clients to determine accurate fair market values of the parties' fine and decorative arts in order to assist with an equitable division of property.

Bankruptcy

Bankruptcy can be a trying and complicated process. Should you and your attorney determine that an appraisal of your fine and decorative art collection is required, Roth Art Group will provide you with fair and accurate valuations of the works in your collection.

Collateral Valuations

More and more lenders are recognizing the value of art as collateral for loans. Lending institutions require well documented and substantiated valuations of the works that will be used as security. Roth Art Group will determine an accurate and defensible valuation of your decorative and fine arts that meets the lending institution's underwriting requirements.

Artists' Estates & Blockage Discounts

The art work that remains in the estate of an artist presents unique valuation issues. An artist's estate may comprise hundreds or thousands of objects. The estate tax considerations may seem daunting to an executor, and you need an appraiser who is familiar with the complexities of valuing a large number of works by one artist. We are experienced in utilizing the business valuation principle of blockage for valuing artists' estate holdings of unsold works for estate tax purposes. Our expertise in this area enables us to prepare highly substantiated reports that will withstand the scrutiny of the IRS.

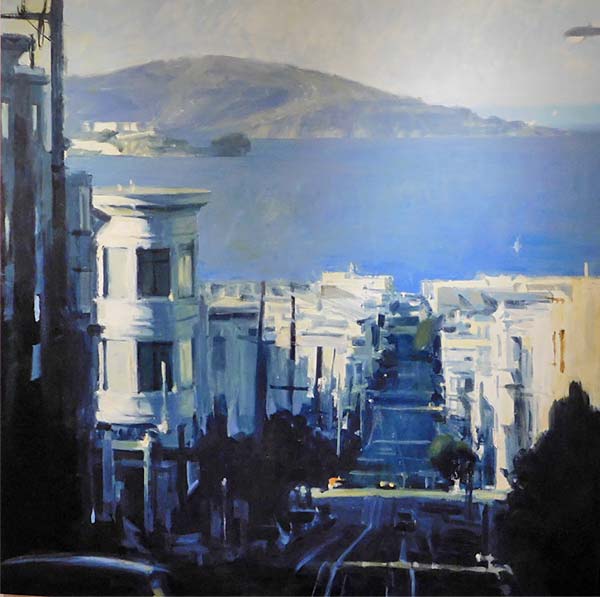

Ben Aronson, View of the Bay from Mason Street, 2015, oil on board, private collection

Alexander Archipenko, King Solomon, 1963, bronze